If you specify multiple conditions, you can choose whether the transaction must meet all the conditions or at least one of the conditions.Ĭonditions can reference the transaction’s description, bank text, or amount.

Conditions: Specify one or more conditions that the transaction should meet to be classified under your new rule. Transactions: Indicate whether you want the rule to apply to transactions that are Money out or Money into either all bank accounts or specific bank accounts.Ĭ.

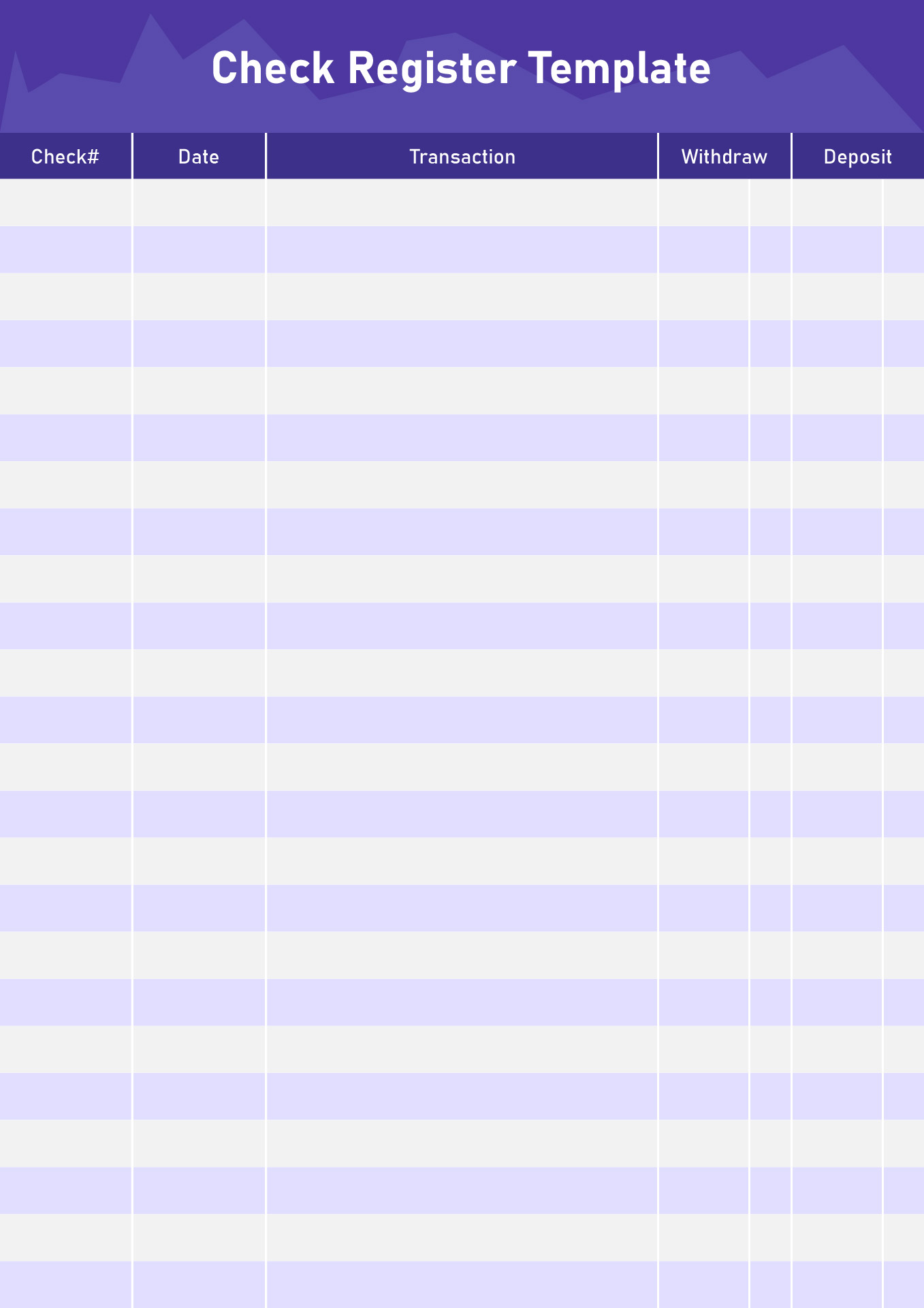

Name: Provide a name for the rule that will make it easy to identify later.ī. Sample application of a banking rule in QuickBooks OnlineĪ. All bank transactions―even if personal―must be entered into the QuickBooks check register. Excluding should be extremely rare and likely only used when correcting for a previous error. Excluded: The Excluded tab lists imported transactions that you have chosen to not transfer to your QuickBooks check register.Categorized: After adding and matching the transactions in the For Review tab, they’re displayed in the Categorized tab, which means they’re already recorded in the check register.For Review: Imported transactions initially appear in the For Review tab where you must add, match, or exclude them.Bank feed transactions: Transactions imported through your bank feed are organized into three tabs: QuickBooks balance: This will be different from the bank balance as a result of bank transactions that haven’t been added to the check register, or transactions in the check register that haven’t been processed by the bank, such as checks recently issued.Ĭ. Bank balance: This is the actual balance in your bank account as of the last time QuickBooks imported your banking transactions.ī.

BANK TRANSACTION REGISTER HOW TO

How to Manage Credit Card Sales With a Third-party Credit Card ProcessorĪ. How to Manage Credit Card Sales With QuickBooks Payments How to Reconcile Business Credit Card Accounts How to Manage Downloaded Business Credit Card Transactions How to Enter Business Credit Card Transactions Manually Part 5: Managing Business Credit Card Transactions How to Handle Bounced Checks From Customers How to Transfer Funds Between Bank Accounts How to Manage Downloaded Banking Transactions How to Enter Banking Transactions Manually

How to Set Up the Products and Services List How to Set Up Invoices, Sales Receipts & Estimates Pending withdrawals, including debit card transactions we authorize and authorized payments known to us, reduce your available balance.How to Customize Invoices, Sales Receipts & Estimates.Refer to the Availability of Funds Policy in the Account Agreement for detailed funds availability information. Funds not available on the day of the deposit will typically be available the next business day, unless a longer hold is placed on the deposit. If funds are not available on the day of deposit, refer to your deposit receipt for the funds availability date. A portion or all of your check deposits made at a Wells Fargo branch, Wells Fargo ATM, or by mobile deposit may be available for your use on the day we receive the deposit, subject to your available balance.Some pending deposits, such as incoming wire transfers, electronic direct deposits, and cash deposited at a Wells Fargo branch or Wells Fargo ATM, are available for your use on the day we receive the deposit. It is adjusted throughout the day as we authorize or receive notice of pending transactions. All deposits that are available and withdrawals that have posted to your account.Your available balance is the most current record we have about the funds that are available for withdrawal from your account.

0 kommentar(er)

0 kommentar(er)